The State of Mobile Advertising, Q1 2014

Highlights for the first quarter of 2014

-

- Android now the No. 1 device platform

-

- Asia solidifies its position in the global mobile ad market

- An in-depth look at the United Kingdom

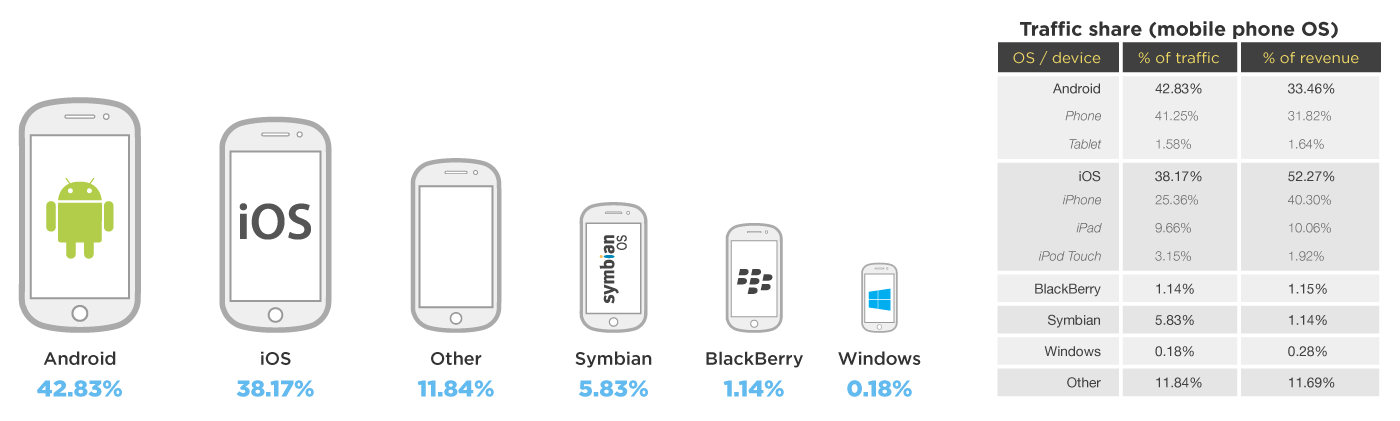

Android is the top platform within the smart device market

After taking over as the leading smartphone platform in Q4 of last year, Android is now the top smart device platform. Although still trailing iOS in terms of monetization, Android is making slow advancement in that category, as well. Last year at this time, Android accounted for 26.72% of revenue, compared to over 33% today. Most of this gain is at the expense of BlackBerry and Symbian.

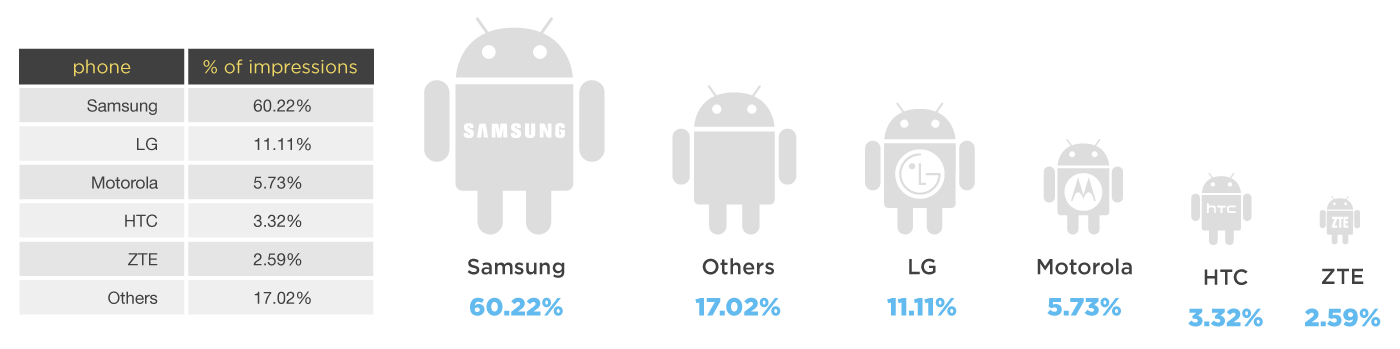

Samsung is the clear leader of the Android device market with more than 60% of impressions.

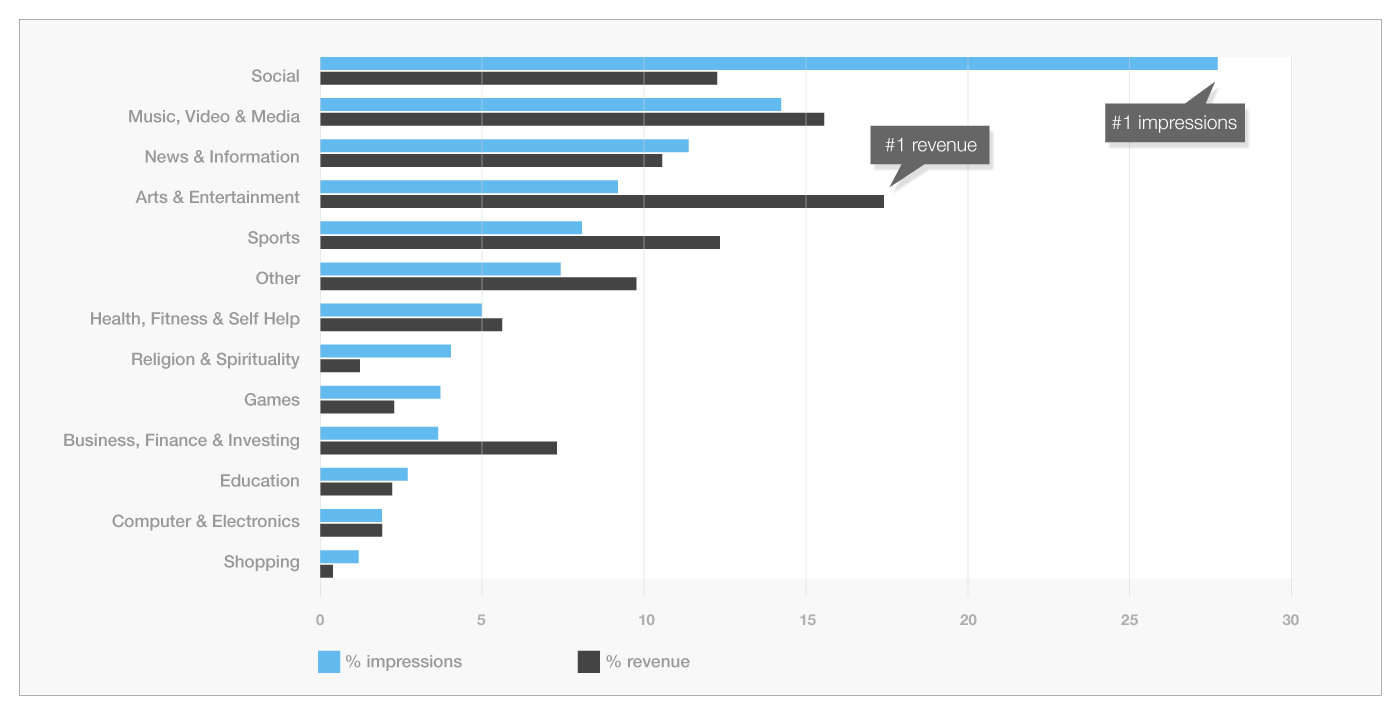

Social-networking services are No. 1 for traffic volume; Arts & Entertainment generate the most revenue

This quarter we’ve seen some changes in the top app and site categories. The Social category leads in mobile ad traffic volume as it did in Q4 2013, but this quarter, the Arts & Entertainment category displaces Music, Video & Media from the top spot for revenue generation. Business, Finance & Investing has the highest revenue per impression, holding its top position for over a year now.

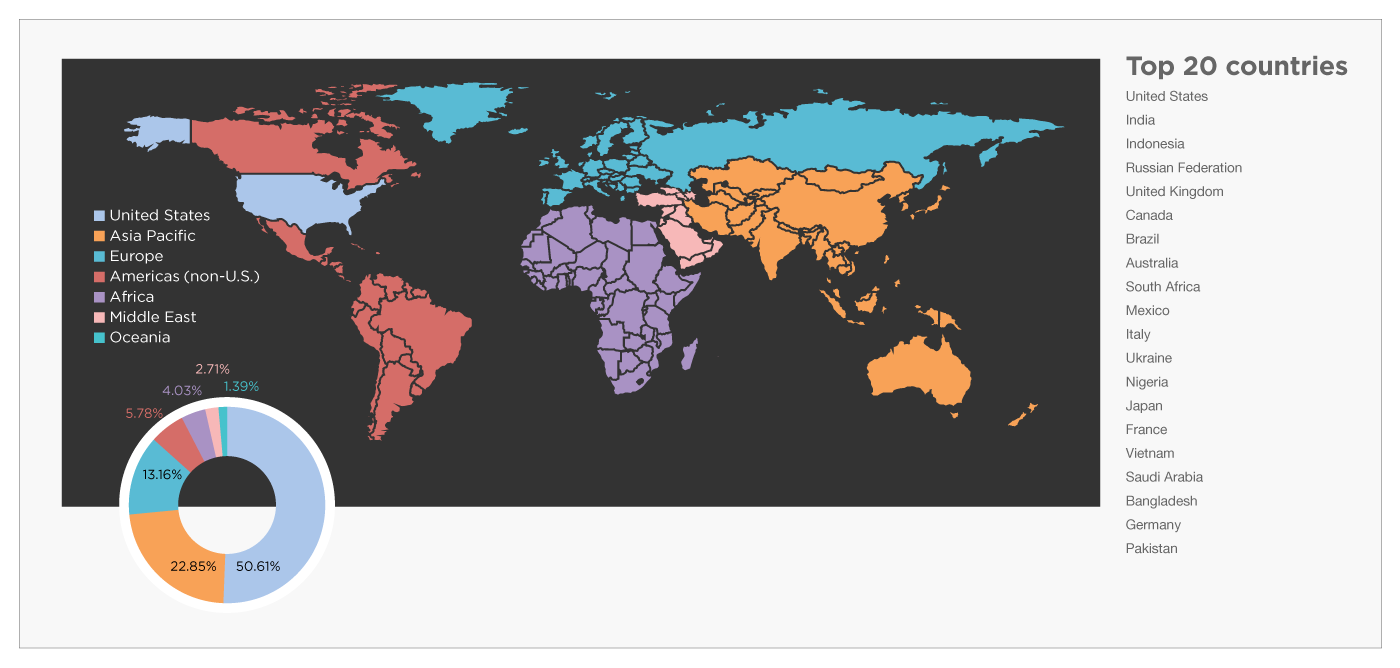

Asia solidifies its position in the global mobile ad market

Even though the United States continues to drive the majority of ad traffic (50.61%) and revenue on the Opera Mediaworks platform, Asia is now in a solid second place. Last quarter we saw Asia leapfrog Europe as the second largest mobile ad market. Asia continues to hold this position, even lengthening its lead on Europe this quarter.

FOCUS ON THE UNITED KINGDOM

The United Kingdom is one of the most advanced mobile markets in the world, and as such it can provide insight to the potential future for global markets. However, when compared to global and other advanced markets today, the U.K. mobile audience shows itself to be truly unique.

Our analysis of the mobile audience in the United Kingdom is based on mobile advertising traffic generated by over 1,000 sites and applications specific to the U.K. market, as well as traffic from UK consumers directed to over 11,000 sites and applications distributed worldwide. Therefore, our first observation is that the U.K. mobile audience is quite international in nature. The audience not only engages with U.K.-centric content but also interacts extensively with a global “who’s who” of digital media sites and applications.

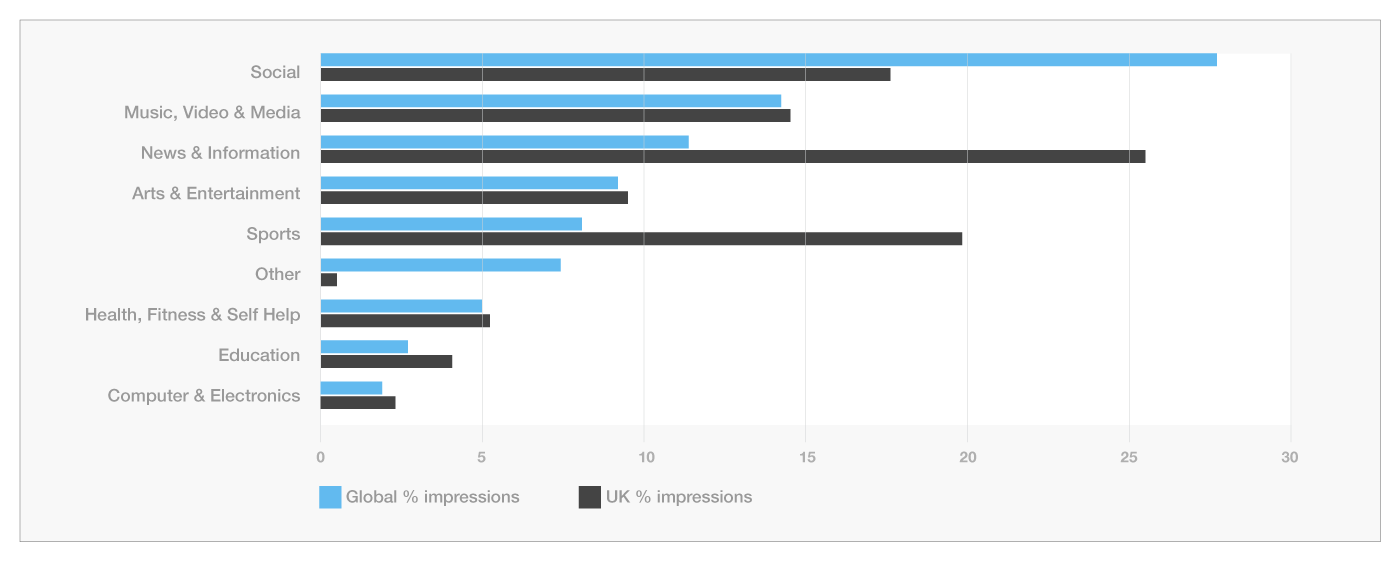

Unique preferences in site category

Mobile users in the United Kingdom interact with advertisements on News & Information and Sports sites much more than the global audience, which favors Social, Entertainment and Music sites. However, when the U.K. audience interacts with non-U.K.-centric sites and apps, those sites tend to be the global favorites: Social, Entertainment and Music.

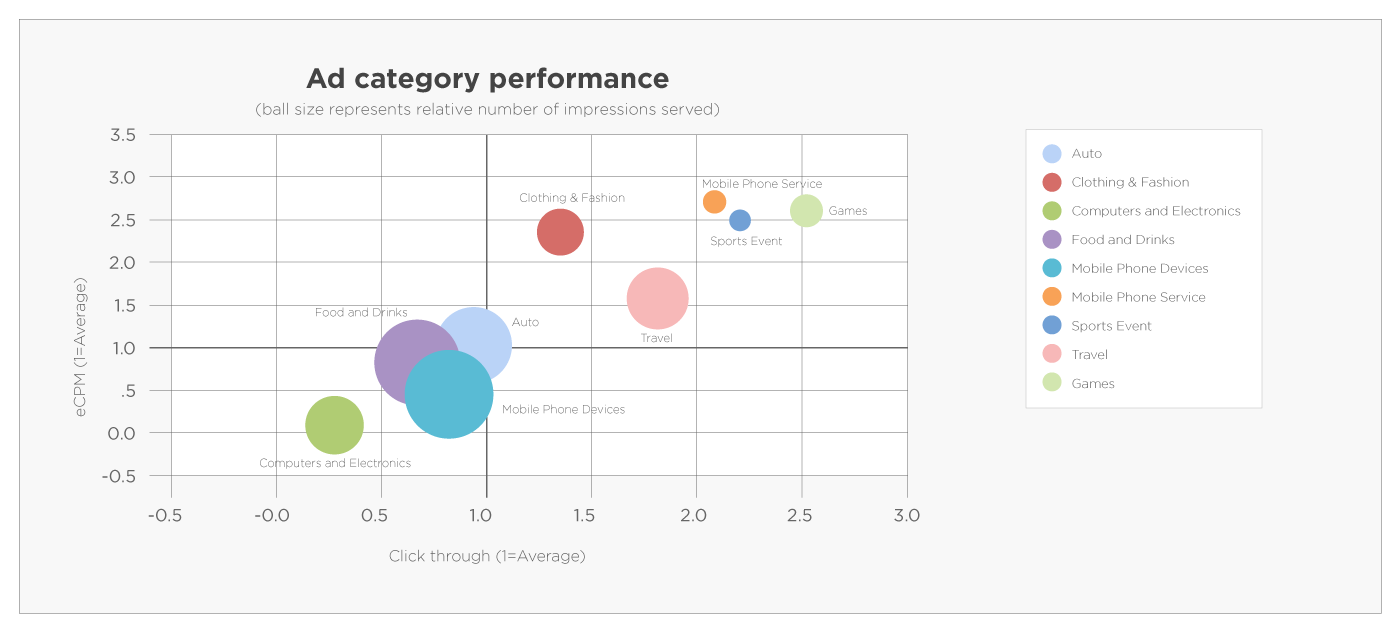

Advertiser category performance

Of the brands advertising on sites popular with the audience in the United Kingdom, those advertising mobile phone services and games have the highest monetization levels (as measured by eCPM). Game advertisers also see the highest click-through rates (CTR), while mobile phone device advertisers produced the highest volume of impressions served.

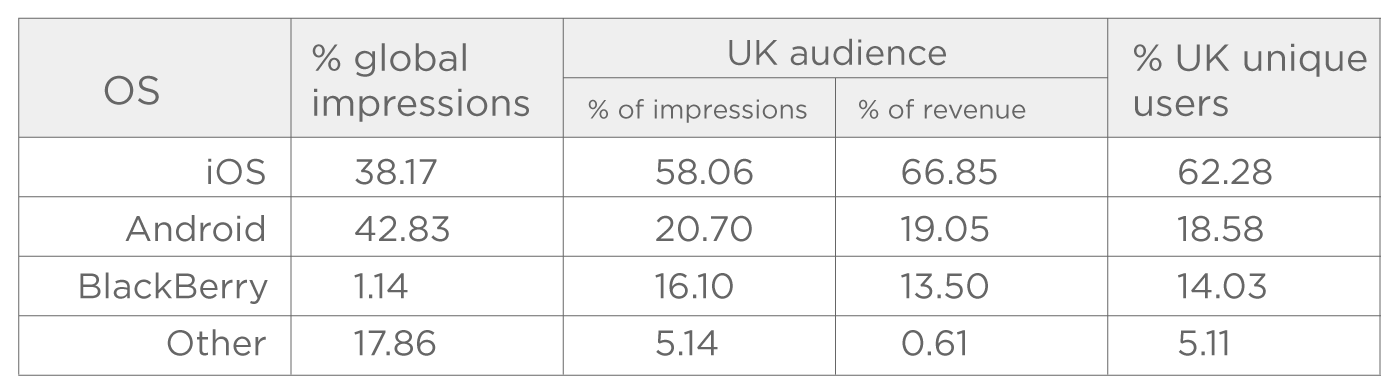

A unique mix of devices

Even though most analysts report a very high adoption rate for Android devices in the U.K. market, our traffic shows iOS to be the clear leader. Also, the U.K. audience is much more likely to own a BlackBerry device than our global audience.

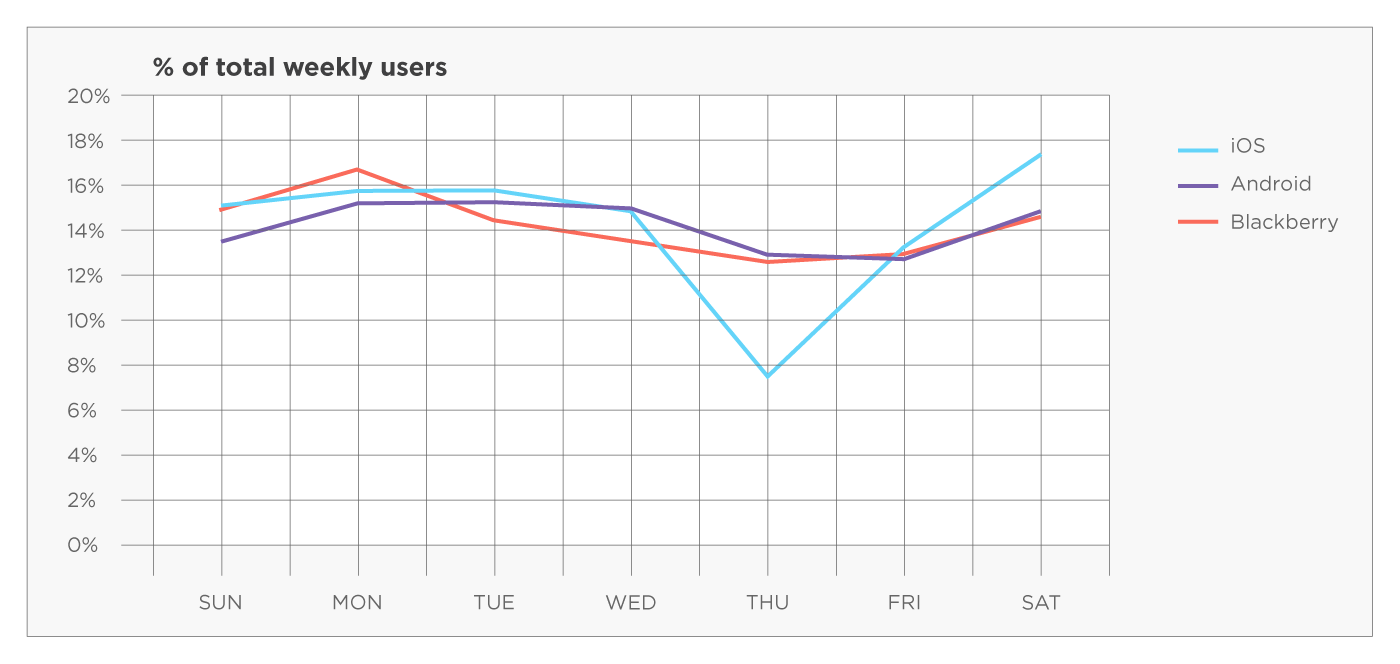

Similar usage patterns across the days of the week

The U.K. audience is similar to the global audience in that it shows strong usage over the weekend period, all the way through Monday. In the United Kingdom, however, we see a much more pronounced drop in iOS users midweek than we do for other platforms, and, for that matter, for iOS in other markets.

Uniquely favor mobile applications, rich media and video

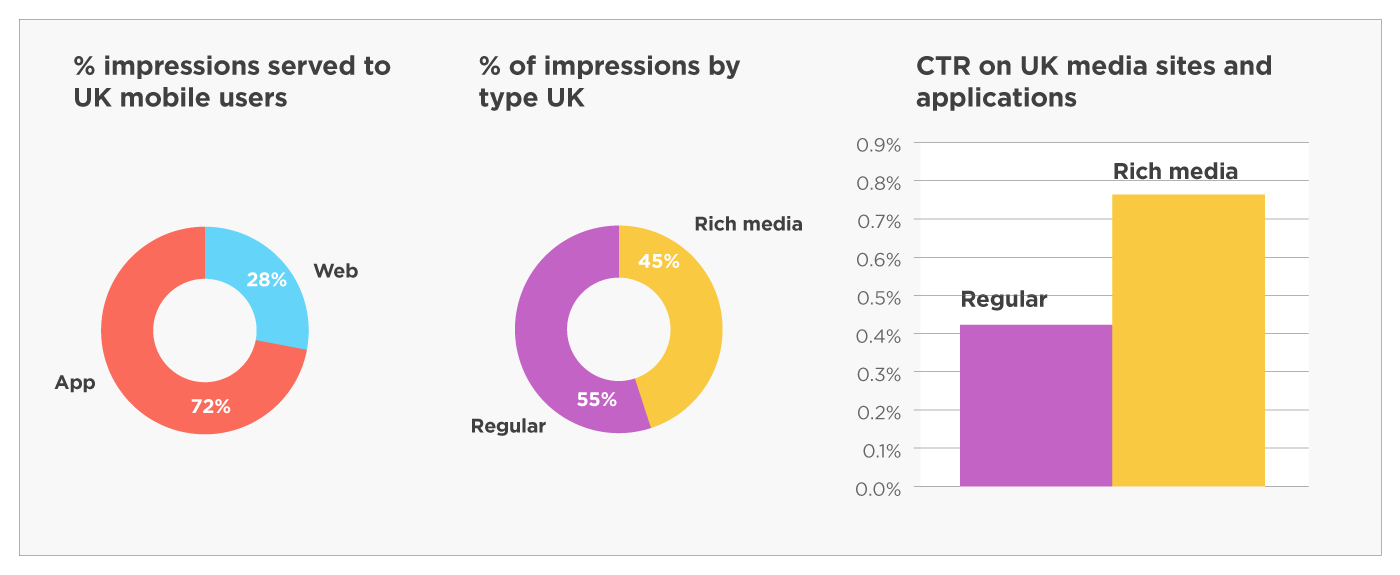

When compared to our global distribution, where 69% of our traffic is for mobile web impressions, the United Kingdom shows a significant preference for engagement within mobile applications, with 72% of ad impressions taking place within a mobile app.

Advertisers and mobile media properties in the United Kingdom show a strong preference toward rich-media advertising, where click-through rates are almost double those of regular banner ads.

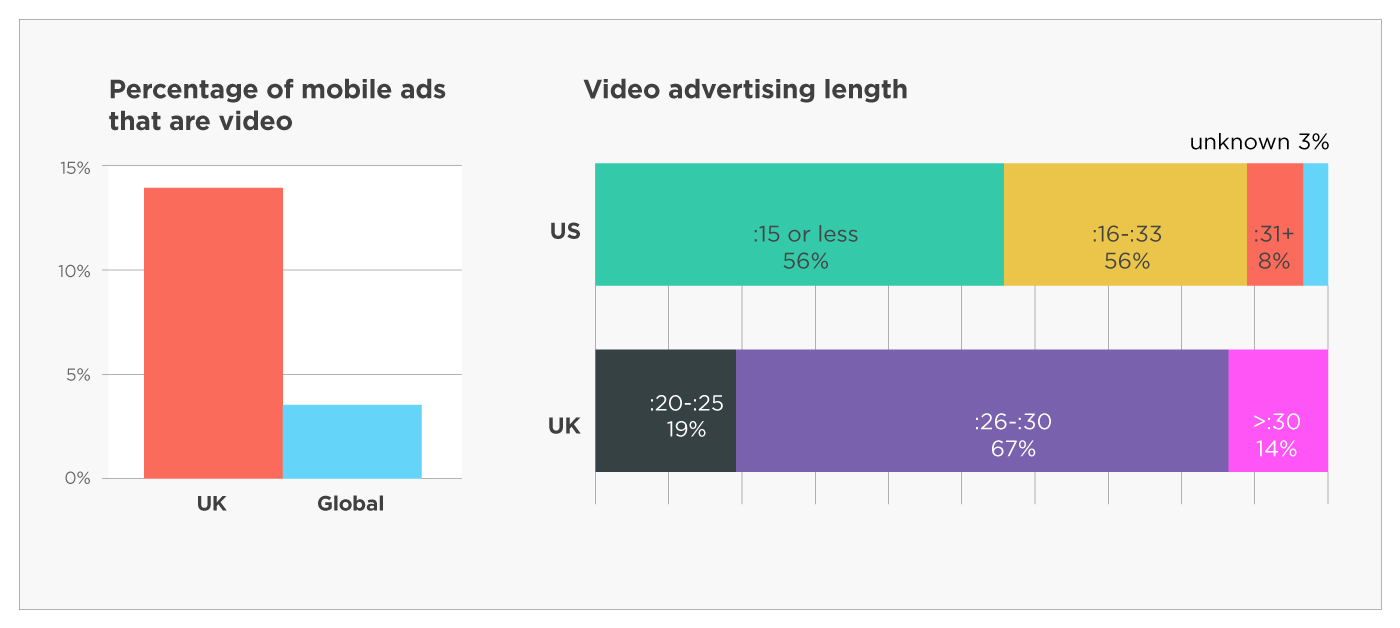

Video ads are a key driver of rich-media success in the United Kingdom, where 30% of rich media advertising (13.4% of all mobile advertising) contains a video. This is significantly higher than the worldwide average, where 2.5% of advertisements contain a video.

In addition, video advertising in the United Kingdom tends to be longer in duration than its U.S. counterpart. Based on research by the Mobile Marketing Association and shown in their “Mobile Video Benchmark Study 2013”, 56% of U.S. mobile ads are 15 seconds or less in duration. In the United Kingdom, our data shows that 67% of video ads are between 26 and 30 seconds long.

Best practices for UK mobile creative

Our experience advertising in the United Kingdom clearly shows that the fewer the barriers an advertiser puts between their audience and the call to action (CAT), the better the engagement. For example, once a consumer engages with a video ad unit, each additional interaction required by the consumer before being able to view the ad lowers the completion rate for the video.

Successful calls to action, especially for video advertising in the United Kingdom, rely on ease of use. Consumers who want to engage with brands demand a fast and easy way to get to the advertiser’s most compelling content. An example of success is a recent Sony campaign for PS4, where the advertiser capitalized on a carefully targeted, automatically playing, rich-media video ad, with a completely unencumbered call to action.