Android leads across APAC, iOS leads in Australia

Rapid smartphone adoption continues, fueling revenue growth via high-value, rich-media and video adsSingapore — Nov 24, 2015

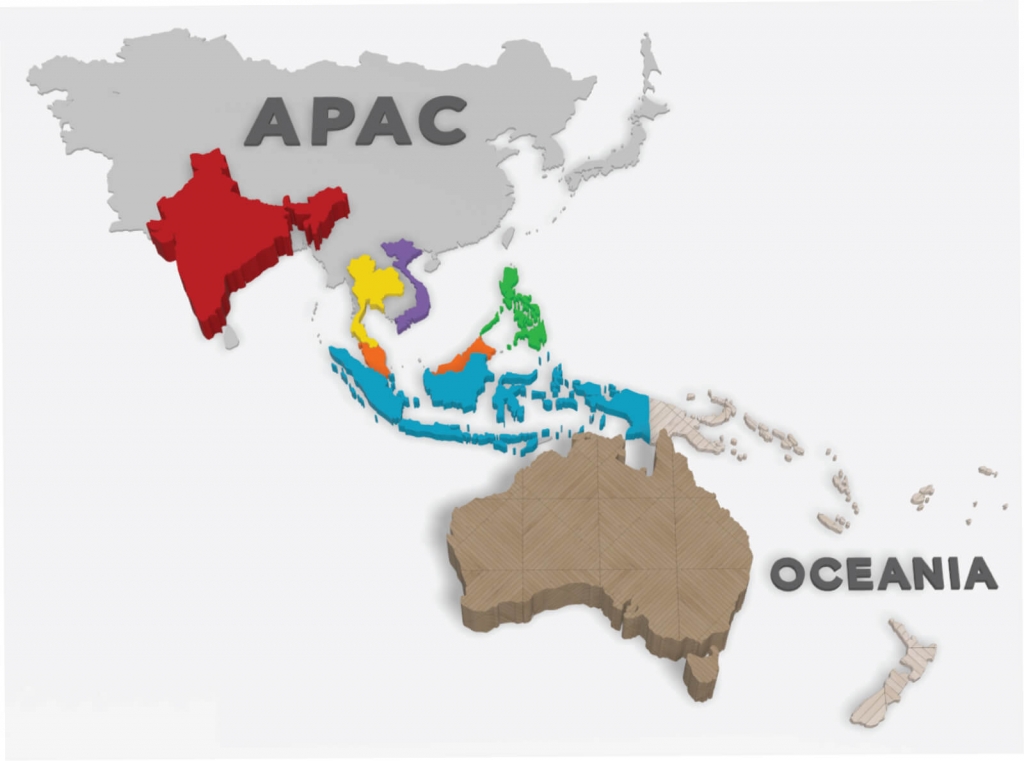

Asia Pacific (APAC) and Oceania are showing a clear and rapid transition to smartphones, according to a Q3 State of Mobile Advertising study from Opera Mediaworks and the Mobile Marketing Association (MMA), released today. Even in markets where the transition from feature phones to smartphones has been slower (Vietnam, Indonesia and the Philippines), about half of the mobile user base has moved to smartphones.

A study of mobile users on Opera’s global mobile-ad platform in six select APAC countries found that Android is the leading OS for smartphones, with 67.1% of impressions being served to those mobile devices (and 30.4% to “other”, or feature phones). In Australia, however, the opposite trend has surfaced: iOS dominates with a 68.5% market share compared to Android’s 30.7% and feature phones on less than 1%.

“The ability to serve high-impact – and therefore high-value – rich-media and video ads on smartphones is what is truly powering the monetization potential of the region,” observes Vikas Gulati, Managing Director for Asia, Opera Mediaworks. “These ad types are effective at attracting, engaging and ultimately converting mobile consumers, so, in markets like Australia where we see a high ratio of video impressions, brand advertisers are seeing strong results from their rich-media campaigns.”

Below are the key findings from the study of the APAC “P6” – India, Indonesia, Malaysia, the Philippines, Thailand and Vietnam – plus Australia.

Key highlights from the APAC SMA Q3 report:

Mobile-device market share and ad types

- While Android market share in the P6 is similar to the global average (65.4%), its share of revenue is higher – 54.9% vs. 44.4% globally. This is likely the result of Android being the go-to OS for smartphones and thus the chosen platform for high-value brand campaigns.

- India leads the region in overall revenue and traffic, accounting for more than half (53%) of impressions. It falls lower, however, in terms of monetization potential, due to the relatively high (25%) share of feature phones. Still, compared to other feature-phone-dominated markets, its share of revenue is equitable to that of impressions, indicating a relatively strong monetization model on “other” platforms.

- Mobile video ad formats command higher eCPMs than rich-media display and even native ads in nearly all of the countries in the study.

Top publisher and mobile-app categories

Mapping content trends by country, Opera Mediaworks and the MMA found that while each country demonstrates a unique profile in terms of audience interests, there were some patterns:

- Mobile stores and carrier portals are the most popular category in most of the countries, the result of feature-phone owners needing to access content and apps through these channels. In fact, 88.5% of unique users to mobile stores and carrier portals are visiting from feature phones.

- Social Networking is the most or second-most popular category for five of the seven countries. It is noticeably missing from the top three in Australia, which is instead dominated by Entertainment, Sports and News & Information.

- In three countries (India, the Philippines and Vietnam), nearly 8 in 10 impressions are served to the top three categories, indicating highly condensed interest areas. Malaysia and Thailand, on the other hand, show traffic going to a wider set of categories.

Audience behavior and interests

The study examines four common mobile consumer segments: Savvy Shoppers, High-tech Enthusiasts, Travelers and Gamers. It found that:

- Gamers have strong preference for iOS, particularly in Australia, where 83% of them use Apple devices. Even in the P6, the preference for iOS is clear, with a 18% share, nearly 7X the P6 average of 2.6%. Cut the Rope is the no. 1 game in nearly every country.

- India, Indonesia, Malaysia and Vietnam all contain a strong percentage of Savvy Shoppers, with such favorite local sites as Tokopedia, OLX, Lelong and Chợ Tốt.

“Asia Pacific is a truly diverse region, and the growth and maturity of mobile marketing has seen the region’s power markets grow from four to six,” says Rohit Dadwal, Managing Director, Mobile Marketing Association APAC. “Collaborating with Opera Mediaworks on this report allows us to make all this data available for marketers, advertisers and publishers and ensure that the industry can adapt and evolve to ensure the region continues to create industry-winning mobile campaigns.”

To view the full report, follow this link.

About Opera Mediaworks

Opera Mediaworks is the first mobile ad platform built for brands, delivering breakthrough marketing at scale. Our technology powers the biggest publishers in the world, enabling marketers to convey the highest quality ad experiences to more people in more places when it matters most. Our exclusive Instant-PlayTM HD video technology and award-winning rich media touches, engages and creates deep interaction with consumers in the most popular mobile apps and sites around the globe. We work with over 90% of the AdAge Top 100 advertisers and 18 of the top 25 global publishers. A fully-owned subsidiary of Opera, Opera Mediaworks is headquartered in San Mateo, California, with offices worldwide. To learn more, visit operamediaworks.com.

About the Mobile Marketing Association (MMA)

The MMA is the world’s leading global non-profit trade mobile marketing association comprised of more than 800 member companies, from nearly fifty countries around the world. Our members hail from every faction of the mobile marketing ecosystem including brand marketers, agencies, mobile technology platforms, media companies, operators and others. The MMA’s mission is to accelerate the transformation and innovation of marketing through mobile, driving business growth with closer and stronger consumer engagement. Anchoring the MMA’s mission are four core pillars; to cultivate inspiration by driving the innovation for the Chief Marketing Officer; to build the mobile marketing capabilities for the marketing organizations through fostering know how and confidence; to champion the effectiveness and impact of mobile through research providing tangible ROI measurement; and advocacy. Additionally MMA industry-wide committees work collaboratively to develop and advocate global best practices and lead standards development.

Mobile Marketing is broadly defined as including advertising, apps, messaging, mCommerce and CRM on all mobile devices including smart phones and tablets. Members include, American Express, AdChina, Colgate – Palmolive, Dunkin’ Brands, Facebook, Google, Group M, Hewlett Packard, Hilton Worldwide, Kellogg Co., L’Oréal, MasterCard, McDonalds, Microsoft, Mondelez International, Inc., Pandora Media, Procter & Gamble, R/GA, The Coca-Cola Company, The Weather Company, Unilever, Visa, Vodafone, Walmart, xAd, Zenith Optimedia and many more.

The MMA’s global headquarters are located in New York with regional operations in Europe/Middle East/Africa (EMEA), Latin American (LATAM) and Asia Pacific (APAC). For more information about the MMA please visit www.mmaglobal.com.